Home Delivery: Gen Z, Millennials, and Their Values Will Define The Market

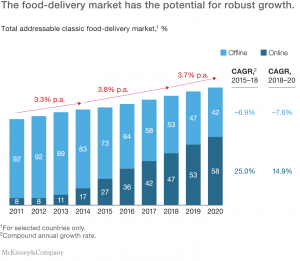

2018 will be a watershed year in local on-demand, particularly home delivery of food. The industry has set down roots in North America, Europe, Asia, and the Middle East. McKinsey projects 25 percent growth for food delivery companies in 2018. UberEats reportedly produced $3 billion in 2017 revenue, suggesting that its revenue could climb by as much as $750 million in sales this year. GrubHub could see more than $170 million in additional revenue.

In short, there is $1 billion+ in growth revenue to be captured by food delivery companies this year.

Multiple models for the preparation of food are emerging:

- Distributed Restaurant Delivery Networks, such as UberEats and GrubHub;

- Centralized Kitchen Delivery Services (office- and home-centric, which account for 16 percent and 82 percent of the market, respectively), a la Deliveroo and Peach;

- Delivery of Prepared Ingredients for Cooking, and;

- Grocery Delivery.

UberEats, which is driving more revenue than the company’s car services in some markets, has carved out an early advantage in prepared meals by partnering with McDonald’s and smaller local restaurants in the U.S., Europe, Asia, and elsewhere in the world. Deliveroo (restaurant delivery), GrubHub (restaurant delivery), DoorDash (restaurant delivery), Instacart (groceries), Amazon (groceries), Home Chef (meal boxes ready for cooking), Blue Apron (meal boxes), among others, are the chief competitors in UberEats’ markets. Deliveroo and Peach have invested in centralized kitchens to prepare their own and local restaurant’s recipes for delivery.

Generational progress is poised to reinforce the trend.

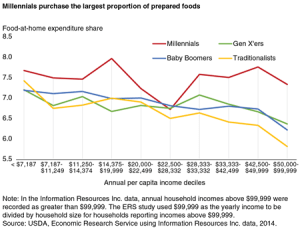

Millennials, who live at home in Depression-era numbers in their 20s and early 30s, and the 18-and-younger Gen Z, who have not had a chance to move out, are redefining the values that influence buying decisions. In particular, they want healthier, responsibly produced food and are more selective than older people, who weren’t offered as much information about their eating choices.

Where older Americans order less food at home, younger people are showing early signs that they have embraced the convenience of home food delivery. Millenials eat out at restaurants more than their parents.

Given the growing values-based scrutiny young consumers apply to their decisions, which may trump convenience and price when deciding what to order, differentiation of services will be essential to food delivery services. Millennials prefer to eat out — for the experience — rather than stay in. However, they haven’t entered their parenting years en masse and we can expect home delivery to displace some dining out as they age. When living with their parents, Millennials tend to buy more prepared food, notably candy, than older Americans.

Gen Zers may be even more home-centric. These 18-year-olds and younger Americans save more, exercise marked resistance to impulse buying, and already represent $44 billion in discretionary spending. They also seem to impact their family’s spending more than previous generations, based on their parents’ reported spending influences. Gen Z has embraced the frugality of the times with discipline and using digital information, doing more research and tapping social sources of recommendations more than earlier generations.

The quality and provenance of food, notably its sustainable production, are the levers of differentiation for these generations.

Millenials and Gen Z will account for more than 60 percent of the U.S. population when they have grown to their majority. They will transform food consumption from a commodity to a values-supported experience. Food and information will be combined to delight the customer and confirm the sustainability and healthfulness of meal time. There lies the missing link: Human trust.

Usability is currently the focus on food delivery platform and app experience. Simplicity, however, does not remove the tedium from selecting meals day in and day out. So much new information, from calorie counts to organic certification, is involved in choosing the next meal. Ordering for children, as well as keeping within a food budget, are just two complexities that Choosing meals is work that will be outsourced, too.

The need for local curators or influencers to craft menus by customers’ personal and demographic preferences is the critical gap in this process. A story of why the food one buys and eats, that they feed to their family, is essential to food delivery success.

Food choices are strongly influenced by media, by tastemakers, and chefs. Especially chefs, who are brand unto themselves these days. The Food Network and its myriad competitors prove the importance of suggested meals and stories to support consumers’ embrace of new foods and unfamiliar cuisines. A week of curated meals, based on a chef or influencer’s recommendations, will be more entertaining than searching through dishes in an app.

A local food media and influencer network closely attuned to regional tastes, trends, and crop quality is the missing layer of this market. As infrastructure investment-driven growth tails off and people find the limits of their patience with meal selection tools, human contributions to the customer experience will transform food delivery from the current gradual growth rate to hockey stick adoption. But for now, $1 billion in growth makes the food delivery market a must-watch sector in 2018.

A version of this article also appeared on Notes & Strategy for the Local On-Demand Economy. Mitch Ratcliffe is cofounder of Gig Economy Group Inc. and a veteran of tech and media startups.

Leave a Reply

Want to join the discussion?Feel free to contribute!