Personalization Advantage In On-Demand Markets: Direct Sales Or Retail?

The economy is going on-demand, following consumers’ desire for immediate delivery of whatever they want. The sales landscape is erupting with innovation like Kilauea volcano, wiping out businesses that fail to adapt. The way out of the swath of destruction is personalization based on consistent content marketing and sales messaging. Is your company in the path of creative destruction or leading the way with technology to rapidly personalize messaging, test results, and share best practices across the organization?

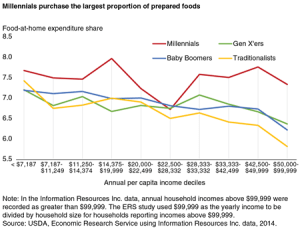

Consumers have embraced personalization of sales experience, as well as product and services delivery to the home. They are also seeking more home-based work opportunities. More than 44 percent of Americans are adding side-work, or “gigs,” to enhance their income. More consumers welcome local expertise when considering a purchase and more people will be seeking part-time work. On-demand markets create both growth and distributor-development opportunities for direct selling brands. The flexible and in-home business model is becoming the norm.

Retailers, including Amazon, Facebook, and Walmart, are moving rapidly to bring the customer journey into the home, too. Amazon has begun deploying the Alexa voice infrastructure to facilitate in-home ordering, digital locks to provide secure home delivery, and, even, offer medical services. Facebook partnered last week with on-demand home services companies Porch, HomeAdvisor, and Handy.com to offer in-home services tied to products sold and delivered to the consumer. WalMart this week introduced Jetblack, a text messaging order service that will bring products to the customer’s home in hours in hours.

Retailers, including Amazon, Facebook, and Walmart, are moving rapidly to bring the customer journey into the home, too. Amazon has begun deploying the Alexa voice infrastructure to facilitate in-home ordering, digital locks to provide secure home delivery, and, even, offer medical services. Facebook partnered last week with on-demand home services companies Porch, HomeAdvisor, and Handy.com to offer in-home services tied to products sold and delivered to the consumer. WalMart this week introduced Jetblack, a text messaging order service that will bring products to the customer’s home in hours in hours.

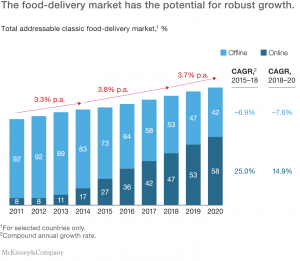

Direct selling and retail brands both face the onslaught of e-commerce, which is eroding the advantage of physical retail as pre-sales customer interaction shifts to digital devices. Trade and business publications frequently announce the end of retail, a claim that should be seen in context: e-commerce accounts for only 10 percent of U.S. retail revenue in 2018, according to eMarketer.com.

For example, Amazon reportedly “owns” 90 percent or more of online sales in home improvement tools, skin care, batteries, golf, and kitchen and dining accessories as of early 2018. However, as a share of the total market, Amazon converts only 10 percent of sales in these categories.

There is plenty of maneuvering room to counter e-commerce with personalized sales and service in the physical world. Resisting the change, though, will lead many companies into dead-ends. Sales experience is fragmenting due to the rise of technology, particularly mobile phones, and the consumer’s developing sophistication and dependence on social influence when buying.

Direct sellers and retailers alike will eventually follow food delivery, home services, and e-commerce into intimate relationships with the customer that start and end in the home. Direct sales companies cannot allow retail to get ahead in the race for individual customer experience. One-to-one selling remains a necessary part of the sales process.

The face-to-face advantage

Face-to-face selling is still alive and well, but it cannot ignore the digital personalization challenge. No longer will a single sales message work for every customer. Direct sellers, who enjoy the advantage of building on personal relationships, will need to craft their messages to deliver better customer experience than retail. Since retailers must first attract customers to their stories, direct-selling strategies are advantaged in the social marketplace. Distributors can develop friendships online to grow their business and forge strong local communities on Facebook, Pinterest, Instagram, and other social networks with the same level of investment of time as a major brand.

The online threat, nevertheless, is existential for consumer products and services companies that fail to recognize change and invest to build personalized and one-to-one customer experience. eCommerce will reach 15.1 percent market share by 2021, claiming an additional $365.68 billion in revenue, mostly from retail stories.

Recognizing that they could be consumed by the digital lava rolling through Main Street in cities and town around the world, retailers are not standing still or playing golf in the volcanic smog. Retailers are leading the charge into artificial intelligence to win a personalization advantage, spending the largest amount of any industry, $3.4 billion in 2018 on cognitive systems to augment their online and in-store marketing, according to market research firm IDC.

The Boston Consulting Group reports that retailer expectations for personalization are very high. In a survey conducted during 2017 by the firm, two-thirds of respondents said they will see a six percent increase in revenue from personalization spending. Half of the respondent retailers with more than 25 employees said they were putting at least $5 million into the machine learning technology last year.

Both direct selling and retail will depend more on personalization to convert sales as mobile-native generations age and become the largest group of workers.

“Over 70 percent of retailers are trying to personalize the store experience. That’s never been higher,” Forrester ebusiness and channel strategy analyst Brendan Witcher told AdWeek. “The reason is because so many customers respond to it. We see nearly three out of four consumers responding to personalized offers, recommendations or experiences.”

Success starts before the sale

Direct sales’ challenge is to stay in front of digital marketing efforts by retailers, which can be accomplished by building best practices within an organization and disseminating them using automation. Pre-sales communication, starting online or in-person, must become a focus of investment to ensure messaging is consistent and relevant. Using machine learning, an enterprise content platform can analyze messages and propagate successful content and sales steps to sales representatives using mobile devices.

Brand discovery also increasingly takes place online. Direct selling marketers must develop campaigns that drive and qualify leads. Content platforms then hand leads off to representatives using automated sales process coaching to deliver all the context to present a personalized experience to the prospect. From the first to the last, every touch must reinforce the brand message to successfully close a sale and establish a long-term customer relationship.

Brand discovery also increasingly takes place online. Direct selling marketers must develop campaigns that drive and qualify leads. Content platforms then hand leads off to representatives using automated sales process coaching to deliver all the context to present a personalized experience to the prospect. From the first to the last, every touch must reinforce the brand message to successfully close a sale and establish a long-term customer relationship.

Consumers today do more research, check facts and customer reviews, as well as depend on conversational confirmation of their buying decisions than any previous generation. Often, engaging with a brand, retailer, or distributor is the last step in the process. Marketers can respond with better pre-sales content that develops trust with consistent messaging through the entire customer journey.

Machine learning-coached sales reps can step into the digital engagement at critical moments to add the human element that establishes trust, something retailers cannot do during their sales process today. Feedback captured by representatives sitting with the customer gives the smart platform hints about how to personalize the experience, refining the suggested content to share and messages the distributor can use to move the sale forward.

“The key to closing deals is presales’ ability to shape conversations with the client to position the company’s solution as the ideal ones,” wrote McKinsey’s Homayou Hatami, Candace Lun Plotkin, and Saurabh Mishra in the Harvard Business Review. “This approach is not about developing a ‘smoke and mirrors’ pitch, but rather investing the time to have a deep understanding of the client’s needs (met and unmet) and then highlighting those elements of the solution that can address them.”

The foundation for a consistent brand message begins with mapping every touchpoint in the sales journey, from pre-sales and discovery through content marketing and sales process steps. The “attribution modeling” process allows management to identify what it expects will happen at each step and, using a machine learning-content platform, rapidly test and revise messages. Instead of launching content one or twice a year, then waiting to see its impact on sales in quarterly or annual results, it can be adjusted as fast as software updates are today.

The speed of software is the new pace of sales in the era of personalization. Companies are beginning to adjust to this accelerated communications cadence, and the tools for in-home personalization are catching up to web-only interactions. The combination of digital and personal engagement is a breakthrough moment in sales.

Personalization is the path out danger for retailers and direct sellers that don’t want to wait for the lava of change to erupt under them. For now, the one-to-one selling community has a sustained advantage over retailers who must attract the customer to their stores. If retailers’ investment in machine learning and personalization goes unchecked, direct selling could fall behind despite their strong foothold in consumers’ homes.