On-Demand Economy Notes: February 4, 2018

Every week sees a new “peak” or “maximally absurd” on-demand economy story, and this was no exception. As I rundown of recent news and data points of interest to on-demand companies, investors, and workers, I keep in mind that this transformation of our economy remains controversial.

It’s a commonplace to argue that “We get the society we’re born into,” but in this era, we can redesign society during our lifetimes. The vast majority of human generations have been stuck in their times because of the slow advance of knowledge and technology. The on-demand economy is only one aspect of a renegotiation of social value, and it can do far better than the first generation of companies if we keep worker retention based on fairness. We need to argue about this passionately and patiently to evolve a more sustainable and equitable economy in the era of technological acceleration.

Send your “Human Uber” instead of going yourself. New York Magazine points to the announcement that Japanese researchers have developed an iPad-based solution to sending someone in your stead. Dubbed a “human Uber” and announced at an MIT form, this may be the most ridiculous and dehumanizing gig economy idea yet, as proved by an Arrested Development running gag based on the idea during its first run on television.

Slapping an iPad over a person’s face to send them to be present for you is stupid and dehumanizing. The joke on Arrested Development revolved around a rich man sending a shlub to attend meetings while he was in prison. Telepresence, on the other hand, makes sense. Scott Hanselman, a former colleague at Microsoft, accomplished a proxy presence without subjecting a human to serving as a meat puppet. Scott worked remotely, sending “Hanselbot,” a rolling platform with a screen, to meetings in Redmond. We don’t need to subject people to this.

Doctors on-demand, that makes sense. Lexology has a good summary of the risks associated with on-demand approaches to healthcare. In addition to the employment risks, such as failing to validate citizenship of workers and changes to healthcare organizational structure, which the articles covers, the rigors of HIPAA compliance, medical privacy, and care standards for non-employee workers are critical to understanding this market. Accenture projected that healthcare investments in on-demand would eclipse $1 billion in 2017.

Josephine announced it will be shutting down in March. Founder Charley Wang, co-founder of the Oakland-based community cooking service, announced the move on the company’s blog Thursday. “We knew that Josephine was an ambitious idea from day one and, as you all know, there have been many highs and lows over the years,” Wang wrote. “At this point, our team has simply run out of the resources to continue to drive the legislative change, business innovation, and broader cultural shift needed to build this business.” Enabling neighbors to cook for one another, Josephine invested in changing California law to allow home-based cooks to sell their food. The site will operate for 60 days, free to the cooks. Wang also said Josephine will transfer cooks’ business information and recommendations for next steps to their members.

Centralized kitchens bets are growing. Kitchen United, a Pasadena kitchen designed to support restaurant delivery and catering services, raised additional funding this month, according to Pasadena Business Now. Combining food preparation with order and delivery infrastructure, the company offers kitchen space by the hour or month to restaurants.

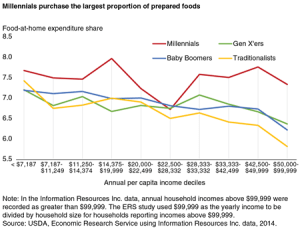

For what it’s worth, the Global Online On-Demand Food Delivery Service Market Overview reports food delivery will grow 32 percent CAGR.

Evernote CEO predicts multi-role software services for on-demand workers. In a short piece on Business News Daily, Chris O’Neill, CEO of Evernote, described an emerging software environment based on users with many work and organizational roles rather than one. He is betting his company on understanding small business’ use of services to establish networks of “products and services.” We wholeheartedly agree with this philosophy at Gig Economy Group. Integration of services will be essential to consumers, as well, because the prospect of managing multiple on-demand services through dedicated apps will be too complicated. “The biggest bid we’re making as a company is to make the product more powerful when you use it with other people, team settings, group settings, nonprofits,” O’Neill said.

African household labor market points to lower marketplace fees. Workclick, a U.S.-Nigerian startup said it will take only 20 percent of worker revenue as a fee for connecting them with customers. Workclick’s app is offered in the U.S., but the workers appear to be only in Nigeria, where it has about 5,000 people on the platform. Low-income countries may be where lower marketplace fees initially take hold in on-demand work. U.S. companies like Uber have taken between 25 percent and 30 percent of revenue. In an age when Amazon and Wal-Mart thrive on sub-10 percent margins, on-demand marketplaces should expect to see their share of revenue under pressure. In low-income countries, labor marketplaces will not support high fees. Workclick’s initial fee structure hasn’t gone that far, but it’s a step in an inevitable direction for on-demand companies.

Careem, the Dubai-based competitor of Uber, Didi Chuxing, and Ola, among others, is profiled by Bloomberg Businessweek. Of note: Careem, currently worth $1.2 billion, is active in 80 cities across 13 countries. Four out of five Saudi Arabian women have used the service, which is training female drivers in the country. The story does a good job of exposing the difficulties of social transformation in the Arab World.

Ford takes Chariot to London. Engadget reports on the expansion of the carmaker’s first on-demand van service to the U.K. Focusing on South London, which is less well served by the Tube, with fares for daily rides between $3.41 and $2.27 after an initial two-week free offer.

Allygator Shuttle, a Berlin on-demand van service, has launched. Smart Cities World describes the service as a partnership between door2door and the Allgemeiner Deutscher Automil-Club, the German auto club and driver services company. The trial will consist of 25 vans running on Fridays and Saturdays only.

Speaking of auto clubs, Jrop wants to obsolete the monthly membership in favor of on-demand tow and roadside repair services. TechStartups.com has a summary. We think

Another flavor of robot. They are already wandering the sidewalk in many cities, and delivery robots are evolving into specialized breeds that will take to the streets. Robomart has a concept design for a fruit-and-vegetable delivery service that brings the produce department to the consumer’s door. Robomart’s concept is a problematic model for two reasons: 1.) It depends on the customer being at home and willing to walk to a van, rain or shine, to select their produce. On-demand services will not monopolize the customer’s time like this. 2.) The produce robot will suffer from the same problem consumers identify at the store, a lack of selection if the van has been picked over by previous customers. Optimizing routes to provide stock refreshment during a day will be challenging.

Crypto your tip? Finally, WIRED’s Zohar Lazar asks why Kudos, a blockchain-based system created by “Uber for buses” company Skedaddle to replace traditional tipping, makes any sense. With so many newly minted crypto billionaires, the solution to tipping isn’t to create a new currency to solve the problem, because the billionaires have a troubling habit of taking their cut first.

A version of this article also appeared on Notes & Strategy for the Local On-Demand Economy. Mitch Ratcliffe is cofounder of Gig Economy Group Inc. and a veteran of tech and media startups.

Here’s the problem with building a purpose-specific marketplace, such as a consumer mobility platform like Uber, Lyft, or Didi Chuxing: Once the platform is saturated, it’s necessary to diversify. In the case of China’s Didi Chuxing, the ridesharing company is adding management of a bike-sharing service, moving into an adjacent, though painful, market with its platform.

Here’s the problem with building a purpose-specific marketplace, such as a consumer mobility platform like Uber, Lyft, or Didi Chuxing: Once the platform is saturated, it’s necessary to diversify. In the case of China’s Didi Chuxing, the ridesharing company is adding management of a bike-sharing service, moving into an adjacent, though painful, market with its platform.

A van containing a 3D printer arrives at your front curb, the plumber knocks and, granted entrance, checks your sink downspout, which is leaking. Problem identified, she calls up the broken part on her computer and prints it in the van, installs the new downspout, and finishes the job. No inventory to carry around, just a focus on service.

A van containing a 3D printer arrives at your front curb, the plumber knocks and, granted entrance, checks your sink downspout, which is leaking. Problem identified, she calls up the broken part on her computer and prints it in the van, installs the new downspout, and finishes the job. No inventory to carry around, just a focus on service.